The State of Digital Publishing According To Successful Website Owners

2020 has brought a lot of uncertainty into the world of digital publishing. When the spread of the Coronavirus spurred global lockdowns, the economic fallout negatively affected ad demand. Subsequently, ad rates plummeted worldwide.

The sudden drop in ad rates caused publisher revenue to decrease. This left even longtime, successful publishers struggling to weather the storm financially.

Now that ad rates have rebounded in the U.S. and other parts of the world, we wanted to gain insight into how the pandemic has affected publishers—during the past few months, currently, and their thoughts on the state of digital publishing at large.

So, we surveyed a group of successful digital publishers to ask questions on media trends, content strategy, and more.

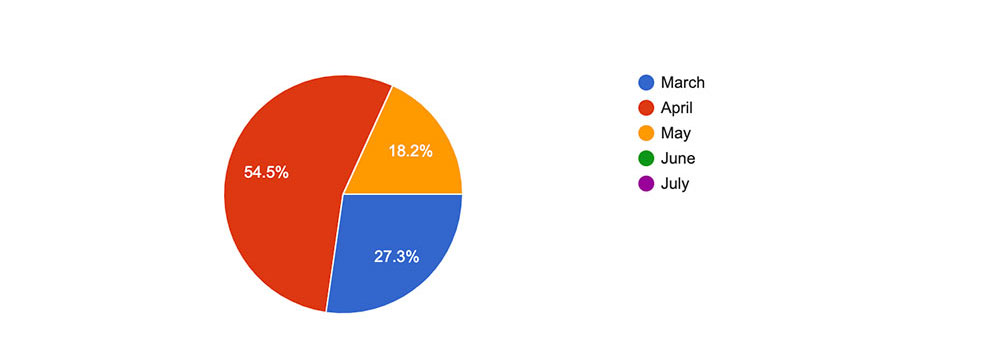

What month of 2020 was your website(s) most affected by the pandemic?

Over 54.5% of respondents said the month their websites were most affected by the pandemic was April. The second-most-affected month was March.

This response mirrors the data from the Ad Revenue Index. April saw the time period with the lowest ad rates, with a slow rebound beginning in mid-May. For those who responded March as their lowest month, this might be because the decline was so severe in March that that’s what publishers remember most vividly.

April 3rd, 2020, was the lowest recorded index reading, with rates staying in the upper 30s and low 40s for a few weeks.

Luckily, June has seen a sharp increase, and most U.S.-based publishers have seen their ad rates return to normal—or even above average for Q2/Q3 at the same time last year.

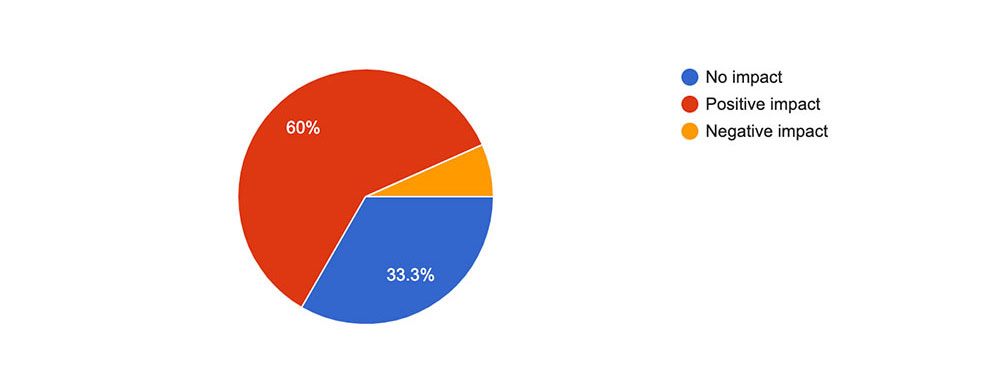

How do you predict recent trends will affect your websites long term?

60% of publishers surveyed said recent trends due to the pandemic have had a “positive” impact on their websites.

How is this possible?

Believe it or not, some publishers actually benefited from changes in search behavior throughout the past few months.

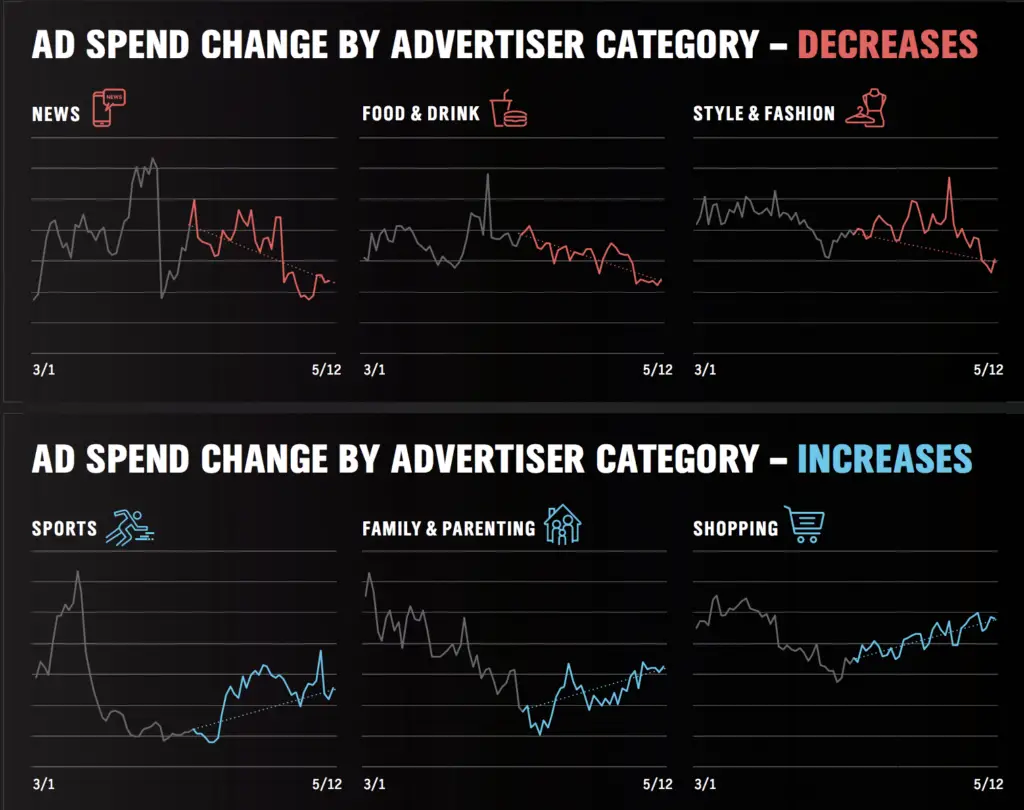

The chart below shows how in the height of the initial lockdowns, ad spend in news, food & drink, and style & fashion decreased.

Yet sports, family & parenting, and shopping ad spend increased during this same time frame.

If you want to know more detailed information on the effects of the pandemic on global ad rates, we wrote an in-depth research article covering the highlights of what’s transpired up to this point.

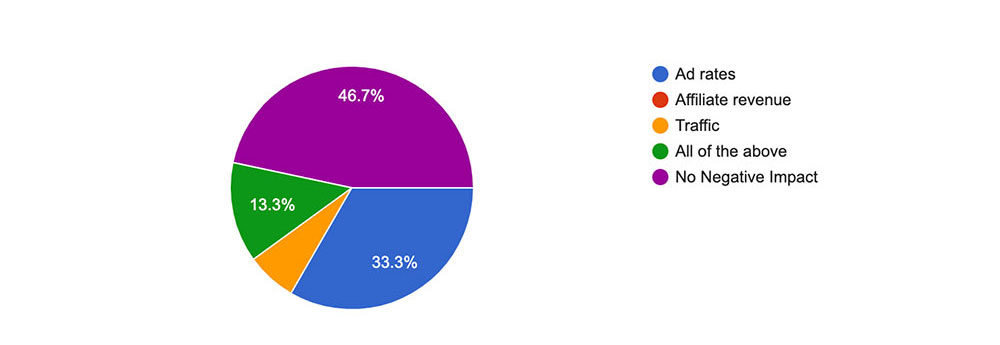

Where has COVID-19 negatively impacted your website the most?

The data show that a little under half (46.7%) of publishers surveyed said COVID-19 had no negative impact on their websites.

While this seems unusually high, the survey was comprised of successful publishers, who typically have a large amount of monthly traffic and revenue. As publishers like these grow, they tend to diversify their revenue streams.

Instead of relying on just display ads, they might have direct deals, sponsored content, paid subscriberships, and affiliate income as well. A group of similar publishers we surveyed in January on top digital content trends for 2020 said that mixed-revenue models were the #1 trend they were most interested in focusing on this year.

For publishers who pursued mixed-revenue models prior to COVID-19, the timing couldn’t have been better. Because if one revenue source dries up, they have others to sustain themselves with until things get better.

After “no negative impact”, 33.3% of respondents said ad rates were affected negatively, and 13.3% said that they saw negative impacts in traffic, affiliate revenue, and ad rates.

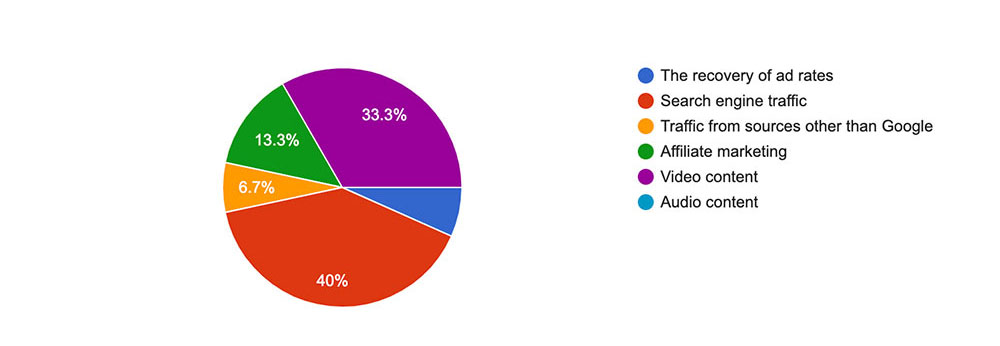

What are you most optimistic about in online publishing right now?

40% of respondents cited that search engine traffic was what they were most optimistic about in online publishing currently. While it isn’t a trend that gives publishers SOS (Shiny-object syndrome), search traffic is the backbone of many websites’ operations.

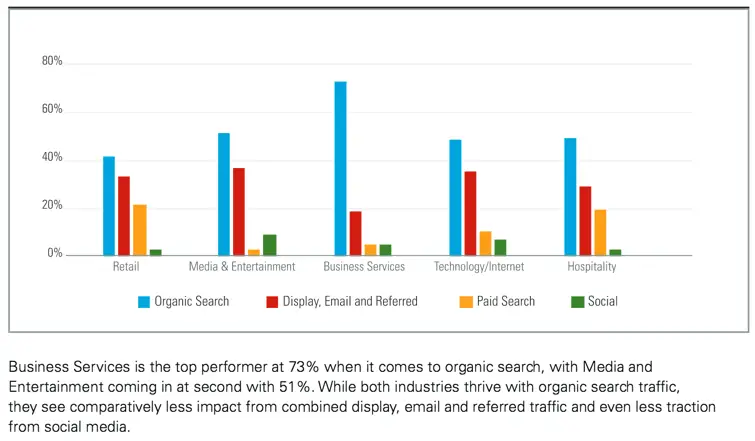

And with good reason. BrightEdge published a study that showed that organic delivers the most “relevant” traffic to websites. This relevance then translates to advertisers spending more. Because advertisers want audiences that are highly-engaged consumers of the content they seek through search.

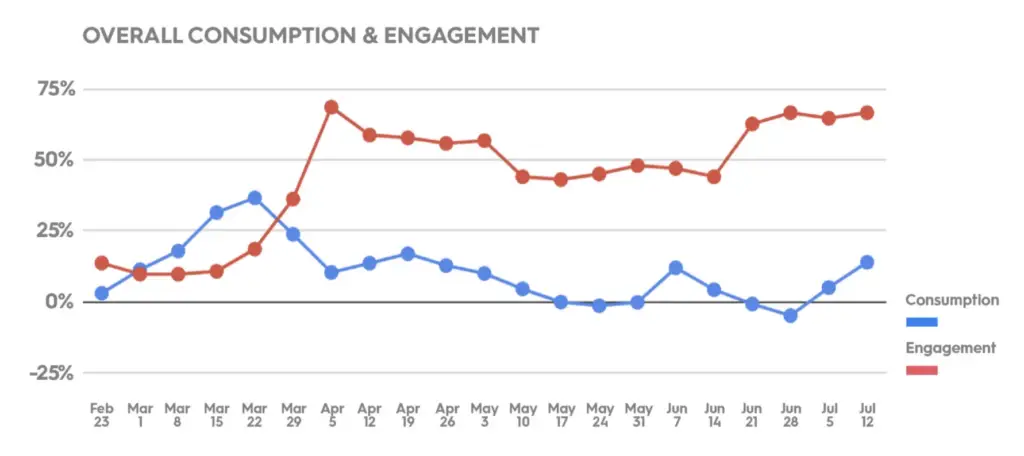

The second-most popular choice was “Video content.” Even with the pandemic ravaging ad rates, video content has seen continued growth in both consumption and engagement.

Primis.Tech’s report saw a rise in engagement that was the highest since lockdown began for many countries in early April, a full 67% higher than pre-COVID. There’s also a positive trend in consumption rates, although less drastic than the beginning months of the pandemic.

What strategy have you used recently that worked out really well?

“I just hired more writers and increased my output during the pandemic.”

“Writing content around long tail low competition keywords.”

“Paid subscriptions.”

“Email marketing funnels and info products.”

“Using Google Autosuggest to find long-tail keywords.”

“YouTube videos in conjunction with blog posts.”

“Podcasting is the best way to drive traffic to my site.”

“The main site I work on is in travel so heavily impacted but even with just domestic travel opening up in the country it is about (Malaysia), traffic is higher than it’s ever been. This gives me confidence about the future. I also spent more time concentrating on other sites I own and starting new ones that are in niches less impacted. This period has definitely shown the importance of diversification.”

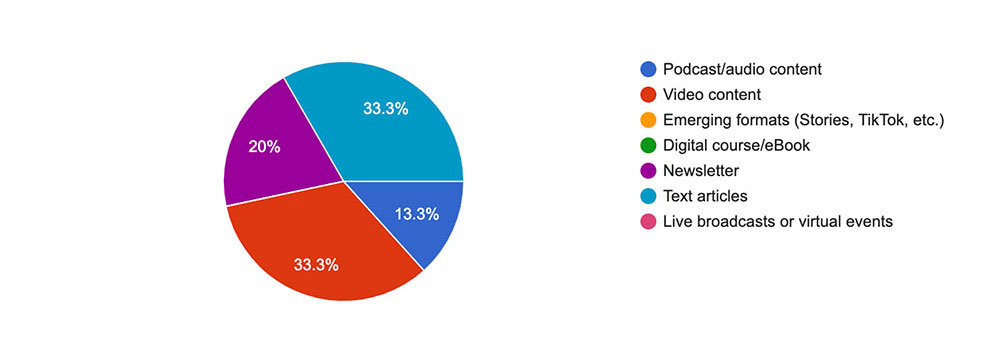

In the future, what kind of content do you plan to invest more in producing?

The respondents’ top choice for the content they plan to invest more in producing was a tie. It was an even split between video content and text articles.

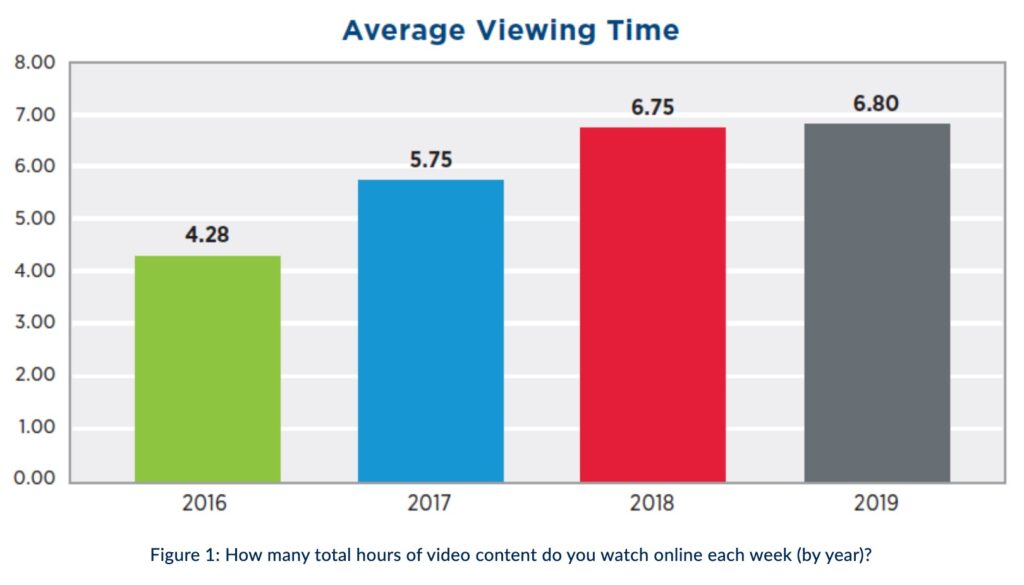

Video content isn’t going away anytime soon. Data shows that the average viewing time of online video per week is 6.8 hours. This is a 58.8% increase in viewing time since 2016.

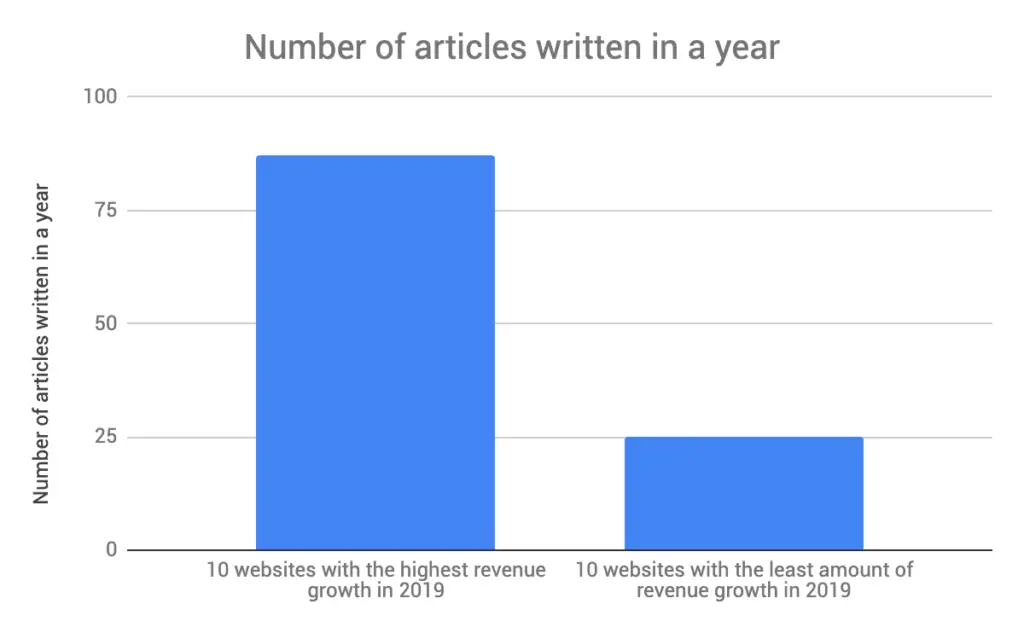

The other half of the tie is textual content, which isn’t much surprise to publishers who have been in the game for a long time. Ezoic’s 2020 Publisher Publisher Performance Report showed that of the 300 publishers in the study, the amount of content written strongly correlated to increased overall revenue

Of the 300 sites, the 10 highest-earning wrote an average of 80 articles in 2019, versus the 10 lowest-earning websites wrote an average of 25.

This is why so many say “content is king.” It’s always a great investment, especially when that content is high-quality and is relevant to user queries.

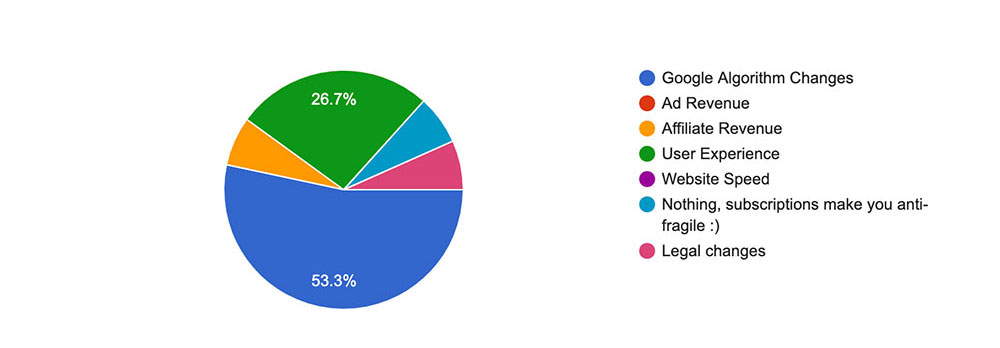

What are you most worried about in the future?

The majority of publishers surveyed (53.3%) said they were most worried about Google algorithm changes.

Even publishers who are just starting to build organic traffic might often fall victim (or be the victor) after Google’s ever-changing algorithm updates. The updates all “aim” to improve a searcher’s experience, but it makes publishers’ lives difficult having to deal with the sudden changes in traffic that might occur if affected by one of these updates.

The most recent being the May Core Update, which was likely triggered by the sudden changes in search behavior due to the Coronavirus.

The second-most worrisome thing for respondents was user experience. Publishers who monetize with display ads all know that ads objectively affect user experience.

This is one of the main reasons why we created Ezoic’s Ad Tester, to help balance user experience with ad revenue. Advertisers treat all visitors differently, so why should publishers serve all of their visitors the exact same ad setup?

News flash: they shouldn’t…

And that’s what Ad Tester gives publishers the power to do—multivariate testing powered by A.I. that tests thousands of variables on a per-user, per-visit basis.

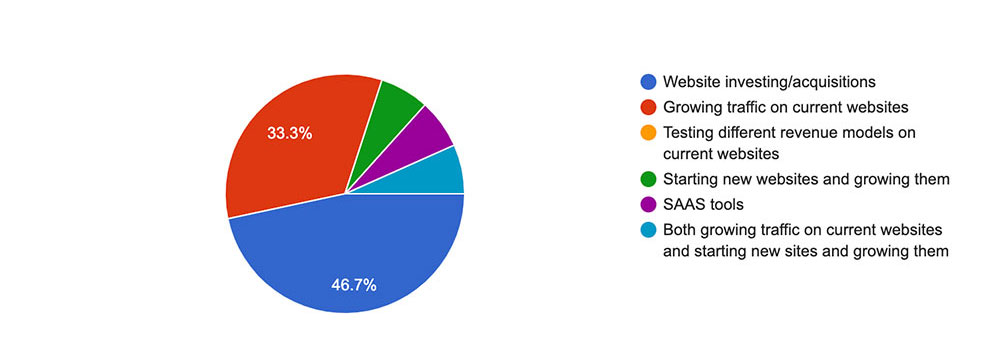

Which of these are you most likely to pursue in the next year to make more money?

The most popular strategy chosen by respondents to make more money this year is “Website investing/acquisitions” with 46.7%. This choice was followed by “Growing traffic on current websites” at 33.3%.

It’s common knowledge that for newer publishers who start websites, the main goal is to grow traffic. Because at the end of the day, more traffic = more revenue.

But what happens when your traffic is growing steadily and you’re already making decent money? Many publishers then decide to scale their digital businesses.

Spencer Haws of NichePursuits.com is a great example of this. He is a serial site builder. He runs more than a dozen sites, and all of them make money. But isn’t that too much to manage for one person?

Of course it is! Publishers like Spencer, who have had major success with building one of their first sites from scratch, tend to outsource the majority of the most time-consuming work that goes into building a site with quality organic traffic for their next project sites.

Think things like content creation (article writing is arguably the hardest and most time-consuming part of building a website), posting posts to social channels like Facebook and Pinterest, etc.

Do you want to one day scale your digital business and own multiple websites? Spencer’s guest post on 8 steps to building a website that makes over 1,000 a month is a great place to start.

What technologies or services do you plan to spend money on for your website business in the next 6 months?

The last question was another open-ended question. Here are some of the responses:

“Email automation and plagiarism checkers.”

“Outsourcing written content.”

“Most my expenditure is on contractors – writers, editors, and virtual assistants to get more content out across my sites.”

“More paid sponsorship.”

Staff, Hosting, content production, some third party services like CRO or direct response marketing, team, definitely a team.”

“More quality backlinks and more content.”

“Email Marketing, Video, and audio.”

“Membership business mentoring.”

“More and more content (writer fees)”

Ahrefs, Surfer SEO, Keysearch.co, and I may test out some heatmaps or Optimize.ly too.”

Wrapping up the state of digital publishing according to successful website owners

2020 has been a turbulent year so far in digital publishing, and also the world at large.

While all publishers’ experiences are subjective and vary, the ones that comprised this survey are from websites owners who aren’t new to the game.

Hopefully, their perspectives on the state of digital publishing help shed some light on what’s worked for them, and what hasn’t. Knowing these types of tried and true strategies early on as a publisher can be a game-changer in the long run.

Do you have any questions on the survey responses? Let me know in the comments.