What does Comscore do?

Comscore is a global media measurement and analytics company. They offer 3rd-party measurement of audience demographics and performance for media across multiple mediums. From their own definition;

Comscore is a trusted partner for planning, transacting and evaluating media across platforms. With transformative data science and vast audience insights across digital, linear TV, over-the-top (OTT) and theatrical viewership, we are a powerful third-party source for reliable measurement of cross-platform audiences.

The idea behind 3rd-party audience tracking is to bring transparency to media and marketing, so businesses can use data to drive growth.

What are Comscore rankings and how do they work?

Comscore’s rankings are founded on the audience measurement services they sell/provide to publishers. The Comscore Media Matrix, which in 2016 accredited by the Media Rating Council (MRC) uses a series of “panels” to measure audiences.

These audience measurement services are often observed by advertisers and agencies. The main differentiator between Comscore and other web analytics solutions (like Google Analytics) is that their primary goal is to measure exactly who an audience is and their consumption behavior. It takes a slightly more traditional way of looking at human visitors since many mechanisms for tracking audiences across television and other legacy mediums are less objective than digital has become. Additionally, their panel method defines pageviews across all sites.

That said, the panels and measurement techniques used by ComScore, and competitor Neilson, both rely greatly on voluntary participation from all ecosystem parties to provide their composite scoring. This means audiences, publishers, and agencies/advertisers must all bend to the will of these 3rd parties if they want to participate in these systems.

Traditionally, the tracking of audiences has been wrought with criticism. But, recent acquisitions by large tech companies, like Moat, have demonstrated the value of tracking across the ecosystem; as both publishers and advertisers have long relied on an arbiter for campaign delivery.

Are Comscore rankings something that advertisers and publishers care about?

Advertisers and publishers do often care about Comscore rankings but not in the way that many might assume. The gross majority of advertisers likely have no idea what they are and pay little attention to these services. Agencies and top 50 brand publishers often pay much more attention to these metrics; as they are typically a point of contention in negotiating ad contracts. Comscore and their competitors live as a middle man in-between.

If a publisher doesn’t include Comscore pixels on their pages (often because they slow down sites and can cause errors), they’ll not be counted in Comscore’s rankings. But that actually doesn’t mean an advertiser won’t target an audience on their site…

... So, advertisers that DO use Comscore when buying through an agency will still target audiences on publisher sites that don’t use Comscore or their competitors.

So, what’s the point if you’re a digital publisher? It depends on the goals of a publisher. There’s little monetary incentive or advantage for just about anyone of the or digital publisher side, depending on which industry expert you ask. However, it is a competitive point of contention among some of the long-running media brands that used to depend on these scores or rankings for TV buying campaigns.

What does the Comscore Panel measure?

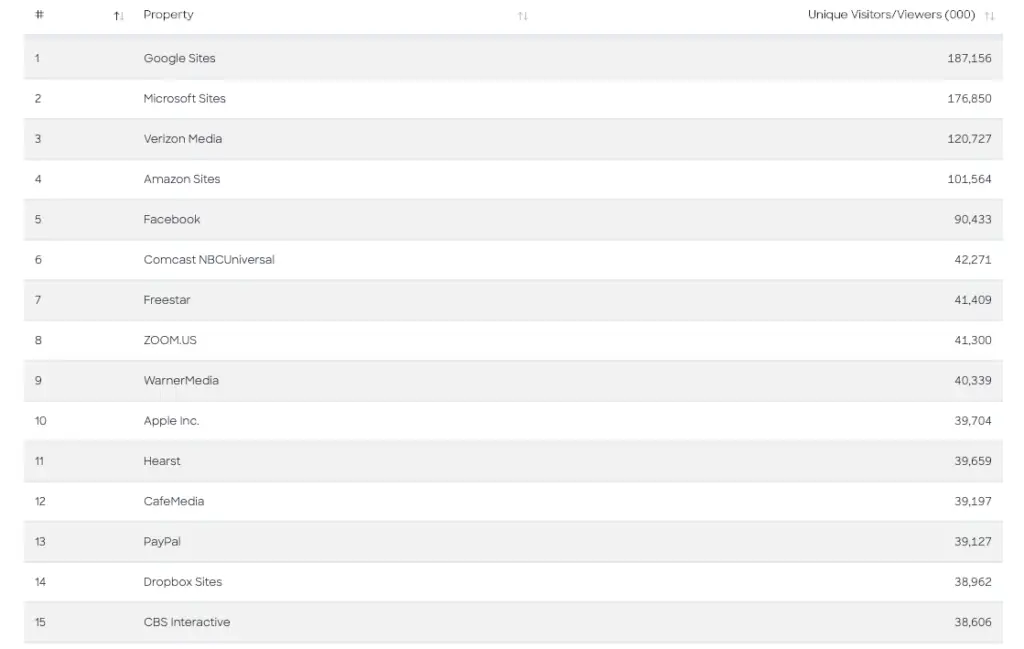

The panel measurements comprise the Comscore rankings—a monthly list of the top 50 digital properties across the web ranked by the number of unique visitors from highest to lowest.

Who or what makes up Comscore panels?

The “panelists” are identified by Comscore as either home or work-based machines. These have to be personally owned by the panelist (or household) to qualify them as home panelists. Computers owned by an employer qualify as work computers.

Some of the things the panel methodology can register unique visits across:

- Internet activity from all web entities, regardless of browser type

- Private browsing sessions / Secure sessions

- Content elements / streaming / instant messaging

- Web-based technologies and protocols

The panel is then weighted and projected to the home and work Internet universes in the United States, which allows the behavior of panelists to be projected to the U.S. Home and Work Internet user populations at large.

How effective is Comscore’s panel measurement system?

Comscore’s panel measurement system appears to be accurate and effective. Out of curiosity, I tested Comscore’s numbers for a digital property in the Comscore Top 50 (Facebook.com) to see if the recorded number of monthly unique visitors was comparable.

To do this, I went to one of Comscore’s competitors, Similarweb. Comscore’s tally for Facebook.com’s June 2020 unique monthly U.S. visitors on desktop was 90.42 million. After crunching the numbers, Similarweb’s was 90.64 million.

They were both nearly equal. The fact Similarweb’s attribution was slightly higher is most likely due to the fact the numbers I used to calculate were rounded up to the hundredth decimal place and not exact.

Why are Comscore traffic numbers lower than those in Google Analytics?

Comscore traffic numbers are lower than those in Google Analytics mainly because of differences in tracking methodologies. Here are some of the reasons why:

Attribution: Google Analytics defines a session timeout as 30 minutes of inactivity. Plus, they have additive rules of attribution. This means 30 mins of inactivity adds up to a new session. Comscore, on the other hand, has a 3-second window to qualify as a visit. Anything less than 3 seconds leads to disqualification.

Multiple browsers: Comscore eliminates visits from multiple browsers and multiple screens (mobile, desktop, etc.)

Non-human traffic: Comscore ignores (or eliminates) bot traffic, and Google Analytics counts all visits regardless if it’s a bot or a real user. This difference is the main factor behind Comscore’s lower traffic numbers. Note: Google now offers a bot-filtering setting to help eliminate invalid traffic.

Data projection: For analytics, Google uses the “real-time” data, and then records and stores the anonymous data. Comscore makes estimations based on the pool of panelists that are tracked via plugins or cookies.

A Comscore whitepaper revealed that cookie deletion might lead to overestimates in servers’ measurement of the size of online audiences. Without adjustments, site server audience reports can be inflated up to 2.5 times the actual number of unique visitors.

Why do ad networks partner with Comscore?

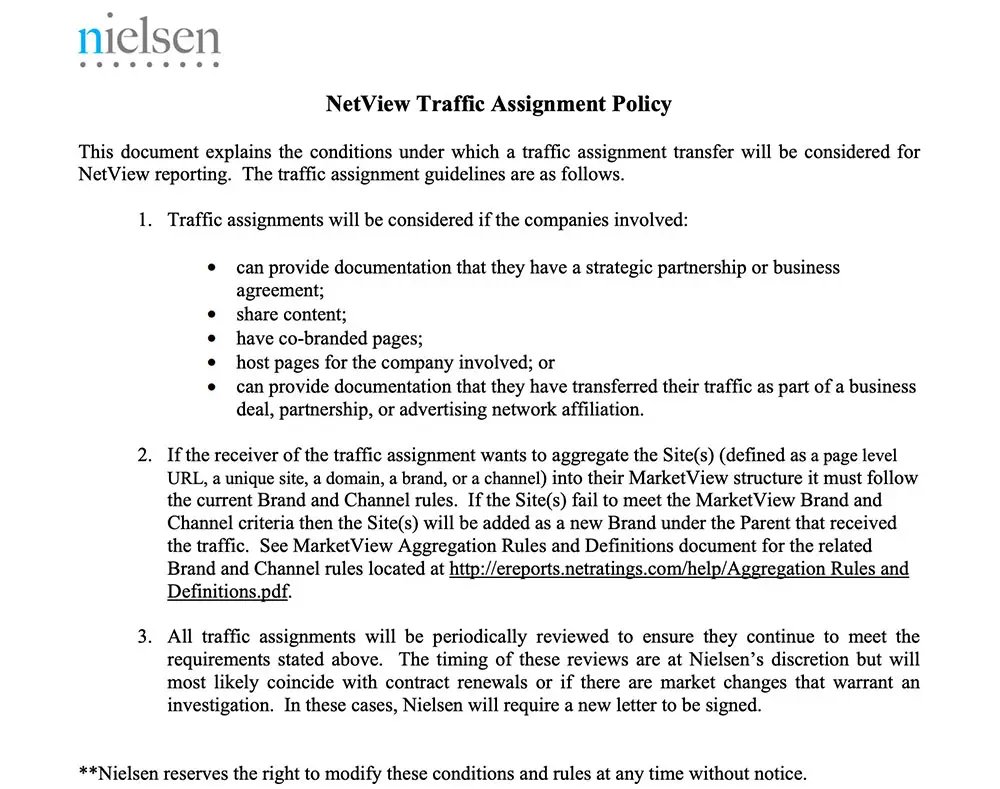

Most ad networks in the Comscore top 50 require publishers to assign their traffic through a Traffic Assignment Letter. What this does is it adds your traffic to their “total unique visits” count and ultimately increases their Comscore property size.

Simply put, ad networks and ad management platforms partner with Comscore because they can leverage your traffic to look “bigger.” Let’s break this down a bit.

This way, when they are trying to attract agencies, direct advertisers, etc., the audience is large. This benefits you as a partner, assuming they are able to deliver on their promises of attracting those types of big advertisers.

From the ad network’s perspective, you’ll probably not ever be able to negotiate the same way a network would be for you. Most networks are into the billions of ad impressions per month, and so that’s what they say advertisers are “looking for” when they want to negotiate.

For those who are more skeptical, some have speculated that the ad networks who pay the hefty yearly price tag it costs to have Comscore measure your audience purely want to make themselves look as large as possible to attract the next publisher in their business pipeline.

What is a Traffic Assignment Letter, and why do some ad networks ask you to sign one?

A Traffic Assignment Letter (TAL) is used to assign a publisher’s traffic to the network they are working with. Once this traffic is assigned, the ad network can negotiate advertising deals for the network at large and for your individual website. The bigger that the network becomes (in the eyes of Comscore / Quantcast / etc), the better the deals they’re able to negotiate. This is what’s intended, at least.

Publishers sometimes forget that they can only assign traffic to one place. Most ad networks typically make you sign a contract to confirm you’ve formally signed over your traffic to live under their network’s umbrella. Additionally, you cannot sign any other deals where you sign over your traffic to a ComScore etc. to other third parties.

Below is an example of a Nielsen Traffic Assignment Letter.

Are there disadvantages to signing over your traffic to a Comscore entity?

Not on the surface, at least. And the ad networks who get to include your monthly traffic numbers into their Comscore total unique visitors count wouldn’t like you to think so. The whole purpose of that is to make themselves look bigger to attract bigger advertisers. But because it seems so simple and innocent, they fail to mention the potential downsides.

The disadvantage is that you are eliminating your ability to diversify certain revenue streams

You’re (most likely) giving a larger portion of your revenue onto the partner.

And the fact that you signed an exclusivity contract? This blocks you from forming other network deals. This is one of the reasons why Ezoic’s Ad Tester, and our whole platform for that matter, were built on the pillars of transparency, the value of split-testing, and no contracts. So, what exactly do I mean by all of this?

Remember: Most TAL agreements state that the new digital property (or ad network is now the sole representative of your site, and what vendors they are using to fill all other inventory (outside of direct sales) you can’t use. If the ad network is well-versed in the industry, they most likely use premium vendors and will not allow you to run traffic by yourself, and instead will run that ad inventory through your site at a specific revenue share.

Note: This may not be true for all ad networks, as every deal is different. But generally speaking, these aspects of Traffic Assignment Letters are true.

What can publishers do to protect the value of their audience?

The best thing publishers can do to protect the value of their audience is to always remain skeptical.

Read the fine print. Don’t sign contracts if you have the option to avoid them. Ask your ad network if you can split test their ad management against another provider.

Because in reality, an apples-to-apples comparison is the only way you’re ever going to know who earns you more revenue. Due to the seasonality of ad rates, fluctuations in ad demand, and frequent Google Core updates, if you test one ad network in one month, and then another in the next month, that’s not a fair comparison. Therefore, you won’t know for certain who was better.

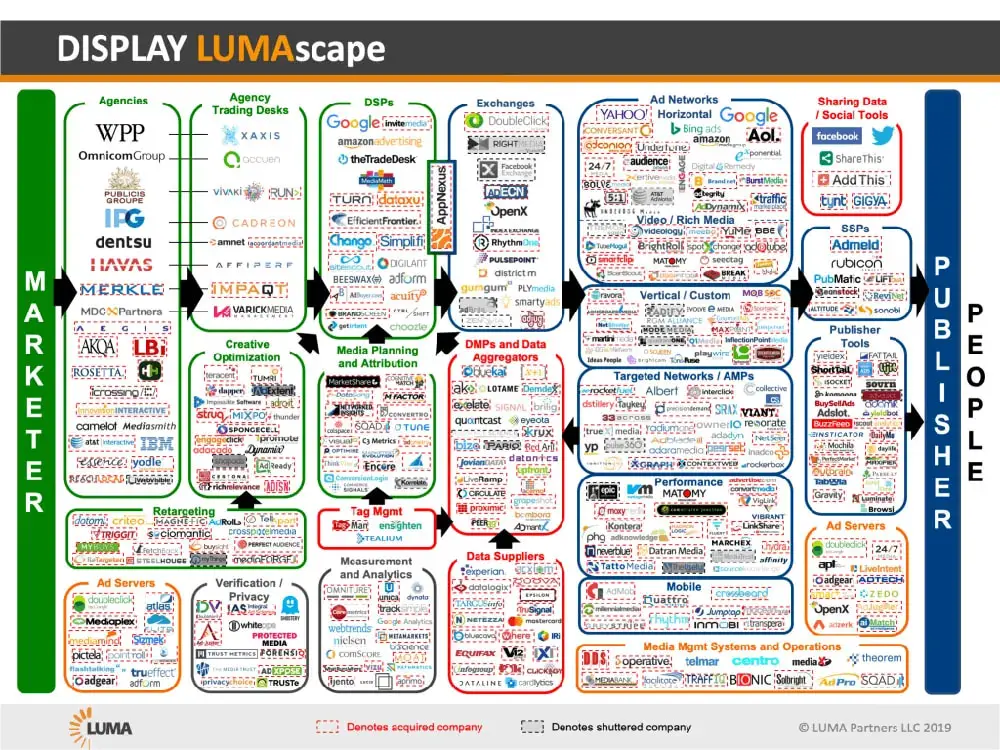

In reality, there’s a lot of scammy players in the ad industry who are draining money from the pot. Yet, those same players don’t add any value back in. One quick look at the Display Lumascape will show you how overwhelmingly bloated ad tech is.

According to research by Technology Business Research, of every dollar spent on programmatic advertising only 40 cents reaches actual consumers. So as unbelievable as that may seem, a whopping 60 cents (or more) of every dollar is being gobbled up by one of the hundreds of entities in the chart you see below.

So it goes without saying, be careful. Recognize the value you have as a publisher, and protect your audience by questioning things and staying skeptical.

Will Comscore be as important to advertisers in the future?

A lot of people don’t think so. Over the years, Comscore has received mixed (praise and negative) sentiment from online publications, and also in forums like Reddit and Quora. The most vocal complaint? Is that Comscore’s whole business model is only beneficial to those digital properties in the Comscore top 50.

Certain incidents in Comscore’s history give enough weight to those negative sentiments.

In 2010, after years of complaints against Comscore undercounting their audience (due to using purely a panel-based measurement without using tracking pixels) came to a head. Quantcast and Google put them under pressure because they offer free tracking pixels via which sites could have their traffic counted. Comscore then evolved to use a “hybrid” model of both panels and site-side tracking pixels.

Afterward, Comscore gave the tracking pixel away for free to paying clients. Everyone else was angry because they had to pay Comscore $10,000 or keep having their traffic counted the previous way. In 2020, the minimum payment to use Comscore’s services comes out to $9,600 per year.

Since then, their stock is near its all-time low. One of the reasons behind the decrease can point back to Q3 of 2019, when The Securities and Exchange Commission charged Comscore’s former CEO with engaging in a fraudulent scheme to overstate revenue by approximately $50 million and making false and misleading statements about key performance metrics.

Objectively speaking, Comscore’s track record doesn’t help its cause. That isn’t to say its measurement tools aren’t valuable, but it makes you wonder;

Are the ad networks in the Comscore Top 50 purely flaunting the “Bigger is better” status to attract the largest advertisers? Or is it more of a selling point to potential publishers to join their network? It perhaps could be a mix of both.

Conclusion

Ten years ago, Comscore was a sign of assurance that a lot of publishers and advertisers were happy to rally behind. But some argue that those on the advertiser-side have always known that Comscore rankings and campaign effectiveness aren’t so stringently tied together.

In today’s day and age, digital publishing and the ad industry at large is more performance-driven. These rankings just aren’t as important as they once were. What’s more important nowadays it’s the audience itself and how valuable that is (directly) to advertisers. There are very few scenarios where you need a large ad network to sit as a middleman. Especially when that ad network makes you sign a contract.

So you see how the puzzle pieces fall together here.

While the biggest publishers might find their audience measurement services valuable (even at their expensive price tag), the Comscore rankings themselves don’t objectively hold the same weight they did ten years ago.

That being said, Comscore is still a big name and well-respected by many in the ad space. So if you’re a successful publisher with a large audience, you be the judge. It’s your audience at the end of the day, and never let anyone (person or ad network) try to convince you for a moment that you need them to succeed.

Because that’s so far from the truth. They need you.

Because without you, they can’t keep getting bigger and bigger…