Changes In Mobile Ads Are Impacting Digital Publishers

In KPCB’s 2015 Internet Trends Report, Mary Meeker noted that the amount of advertising budgets allocated to mobile was poised for growth. The figures available at that time were from 2014 and indicated that although 24% of total media consumption time was spent on mobile devices, only 8% of advertising spending was spent on mobile ads. So, how are changing mobile ads impacting digital publishers?

In KPCB’s 2015 Internet Trends Report, Mary Meeker noted that the amount of advertising budgets allocated to mobile was poised for growth. The figures available at that time were from 2014 and indicated that although 24% of total media consumption time was spent on mobile devices, only 8% of advertising spending was spent on mobile ads. So, how are changing mobile ads impacting digital publishers?

Note that these percentages are based on all forms of media advertising, including print, radio, television, internet and mobile. When you restrict the same data to just looking at Internet advertising, mobile accounted for approximately 25% of all Internet ad revenue or $12.5 billion of a total $49.5 billion. That’s still quite a disparity when you consider that almost half of an average adult’s daily Internet usage time was spent on mobile devices in 2014.

Since that time, we have seen the gap between mobile media usage and ad spending starting to narrow. In 2015, mobile devices accounted for slightly more than 50% of average daily usage time, while data from the first half of the year shows mobile being responsible for about 30% of total Internet ad revenue.

There’s still quite a bit of room to grow, but if trends continue in the direction they’re currently going, we could see mobile ads taking over the top slot within a couple of years. In fact, PwC forecasts that mobile advertising will exceed display advertising in 2018 and account for almost $56 billion in ad revenue.

Mobile Ads Are Driving Facebook’s Growth in Ad Revenues

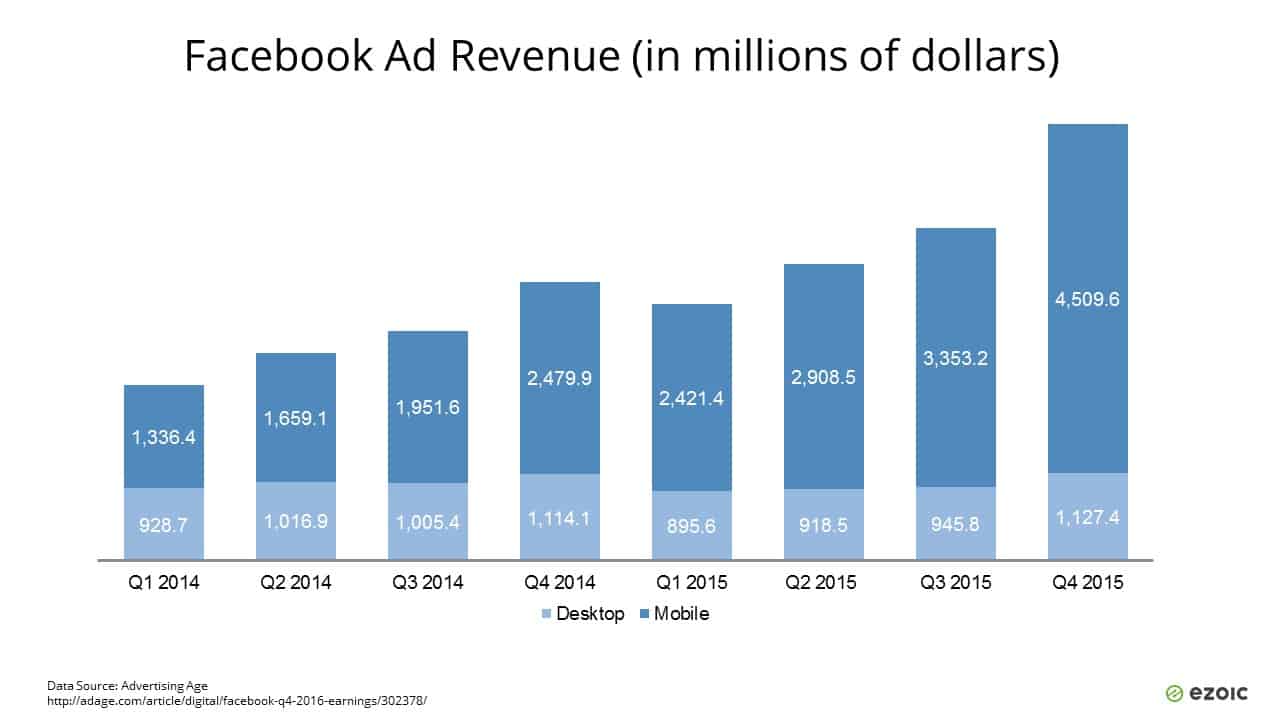

Back when Facebook held its IPO, there were some concerns in various circles over whether or not the social media giant would be able to come up with a successful monetization strategy for mobile. That’s definitely not the case today. Facebook may not have started selling mobile advertising until 2012, but mobile ads now account for over 80% of the platform’s total ad revenue. That is, in the fourth quarter of 2015, $4.5 billion of Facebook’s $5.6 billion ad revenue was generated by mobile ads.

All in all, Facebook’s mobile ad business grew 82% from Q4 2014 to Q4 2015 while desktop ad revenue stayed fairly flat with just 2% growth. The average advertising revenue per user continues to grow as well. In Q4 2014, that figure was at $2.62 per user and in Q4 2015 it had climbed to $3.60 per user.

We’ve already seen Facebook undergo a strong consolidated effort to improve quality, and this is expected to continue.

We’re likely to see even more growth in the coming months as the Facebook Audience Network (FAN) extends to include more publishers, allowing them to start showing Facebook ads on any mobile website. This could be an interesting opportunity for mobile publishers who have been depending mostly on Google AdSense to monetize their mobile properties – especially with FAN’s support of native ad units.

To learn more about FAN, check out the documentation pages on the Facebook for Developers site.

Impact of Facebook Instant Articles and Google’s AMP

As mobile usage and attention to the mobile user experience continues to grow, another issue that will impact publishers who use ads to monetize their sites is the development of new publishing formats, such as Facebook Instant Articles and Google’s Accelerated Mobile Pages (AMP) Project. Both of these formats are focused on improving page load times on mobile devices, and as such, place certain limits on what types of ad strategies can be utilized.

Facebook Instant Articles is a format that allows users to open and read articles that are shared on Facebook without ever leaving the platform – that is, users don’t actually visit the publisher’s website in their mobile browsers. Because of its native format, this type of content loads much faster and is more likely to be viewed by Facebook users. According to Facebook, Instant Articles receive 20% more clicks, are 70% less likely to be abandoned and are shared 30% more often.

Sounds pretty good so far, right? Well, the potential downside is that publishers do have to follow Facebook’s ad policy guidelines when monetizing Instant Articles. These guidelines include limiting the number of ads shown and placement of these ads. Additionally, while publishers can use their own ad servers, all ads on Instant Articles must be directly sold or delivered through Facebook’s Audience Network.

Unlike Instant Articles, webpages created using Google’s AMP format can be viewed in any web browser, but AMP places heavy restrictions on the use of JavaScript. This definitely has the potential to greatly speed up page load time, but it can also limit a publisher’s choice of ad networks. Although several networks – including AdSense, Criteo and Revcontent – are already AMP-compliant, many others are still trying to catch up.

Publishers who do offer AMP versions of their webpages may see a boost in mobile traffic since AMP pages are marked as such in Google’s Mobile Search product, signaling to users that the page has been optimized for faster loading. So, when evaluating different mobile advertising networks, publishers who are already utilizing AMP (or thinking about doing so) may want to add AMP-compliant to their list of needed features.

Ad Blocking on Mobile Devices

The use of ad blocking software is on the rise with a global growth of 41% from Q2 2014 to Q2 2015. Most of this growth, however, is still connected to desktop and laptop usage. According to a report from Adobe and PageFair, despite the fact that mobile devices are now used for a significant percentage of online browsing, less than 2% of ad-blocked traffic was from mobile devices in Q2 2015.

Unfortunately, this percentage will probably be much higher in the next set of reports we see due to iOS 9’s allowance of content blocking extensions for Safari and continued development of ad blocking technology. This is something that publishers may want to keep in mind as they continue to build out their mobile monetization strategies.

Exploring Other Mobile Advertising Options

Even though many ad networks now support responsive ad units that will resize for the device upon which they’re being viewed, other ad platforms are also developing formats specifically for mobile. These options, along with increasing competition between AdSense and the Facebook Audience Network, will most likely lead to additional innovations meant to appeal to both advertisers and publishers.

Because of this, publishers may want to start investigating alternate monetization strategies for their mobile web properties to see which ones offer the best potential for higher ad earnings. If you’ve depended mostly on AdSense in the past, now may be a good time to do some testing to see if there are other solutions that work better for your site. Here are a few that you might want to check out.

AdMob – AdMob is Google’s platform for monetizing mobile apps. In addition to supporting banner, interstitial and video ads, AdMob also features a free mediation service that allows you to run other ad networks through its platform. Due to the Google name, there is no shortage of advertisers on the platform so fill rates are among the highest in the industry.

Millennial Media – Part of One by AOL’s publisher suite, Millennial Media offers a full range of monetization solutions for mobile web publishers and app developers. Supported ad formats include native ads, expandable banners, interstitials and video.

Smaato – Describing itself as a “mobile-first” ad server, Smaato is quick and easy to set up and supports a diverse number of mobile ad formats. That platform places a high emphasis on ad quality to help protect your audience from fraudulent or deceptive ads.

In addition, you may also want to check out some of the top ad networks that offer responsive ad units and other mobile-friendly formats.